Consumer Fraud Alerts

Fraud continues to rise, and we want to help keep our customer-owners informed and protected. Below are some of the latest scams making the rounds—stay alert and stay safe.

Keep in mind, if you receive a suspicious message that appears to be coming from us, or discover a potentially phony Farm Credit of the Virginias print or digital communication, please let us know by calling (800) 919-3276, or by sending an e-mail to info@fcvirginias.com so that we may take appropriate action.

- Reasons to Obtain Owner's Title Insurance

What is owner’s title insurance?

When you purchase your home, you receive a document usually called a deed, which shows the seller transferred their legal ownership, or “title” to their home, to you. Title insurance can protect you if someone later sues and says they have a claim against the home from before you purchased it. Legal claims could come from a previous owner’s failure to pay taxes, or from contractors who say they were not paid for work done on the home before you purchased it. (Source: https://www.consumerfinance.gov/ask-cfpb/what-is-owners-title-insurance-en-164/)

Why should you elect an owner’s title insurance policy?

There are many reasons to obtain owner's title insurance, but the primary benefit is protecting your largest investment and reducing the risk of fraudulent real estate transactions. With fraud on the rise, the protection an owner's title insurance provides cannot be understated. The acceptance or denial of the owner’s policy will not impact your loan decision with Farm Credit of the Virginias.

View 'Reasons to Obtain Owner's Title Insurance' infographic

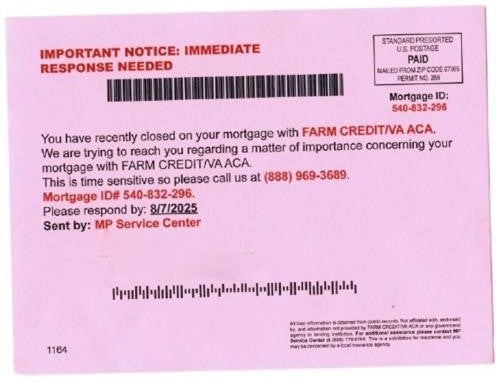

- Mortgage Postcard Scam

Have you received a postcard or letter about a time-sensitive issue with your loan account or mortgage urging you to call an unknown phone number? If you have, you are not alone. Scammers across the country are pulling public data records to target you and your information.

What are these postcards and who is sending them?

These postcards (which come in a variety of colors) are being sent to consumers across the country. Please be aware that this is a scam and the postcards did not come from Farm Credit of the Virginias. There is even a disclaimer in the bottom right corner indicating the sender is not affiliated with our ACA.

How did the postcard senders get my information?

At Farm Credit of the Virginias, we’re committed to protecting our customer’s personal information. We would never send you a postcard requesting that you call us regarding your mortgage or loan account. We do not sell or otherwise distribute our customer's personal information to non-affiliate third parties. Some information about loans and mortgages, regardless of what lender the consumer works with, is public record. That’s how someone may obtain your contact information. Note that the account number listed does not match yours; this should immediately alert you to the likelihood of this being a scam.

Should I call the number on the postcard?

We advise our customer-owners to NOT call the number listed.

What should I do if I get this postcard?

The best thing to do is disregard the postcard. Please let us know by calling (800) 919-3276 or by sending an e-mail to info@fcvirginias.com so that we may take appropriate action.

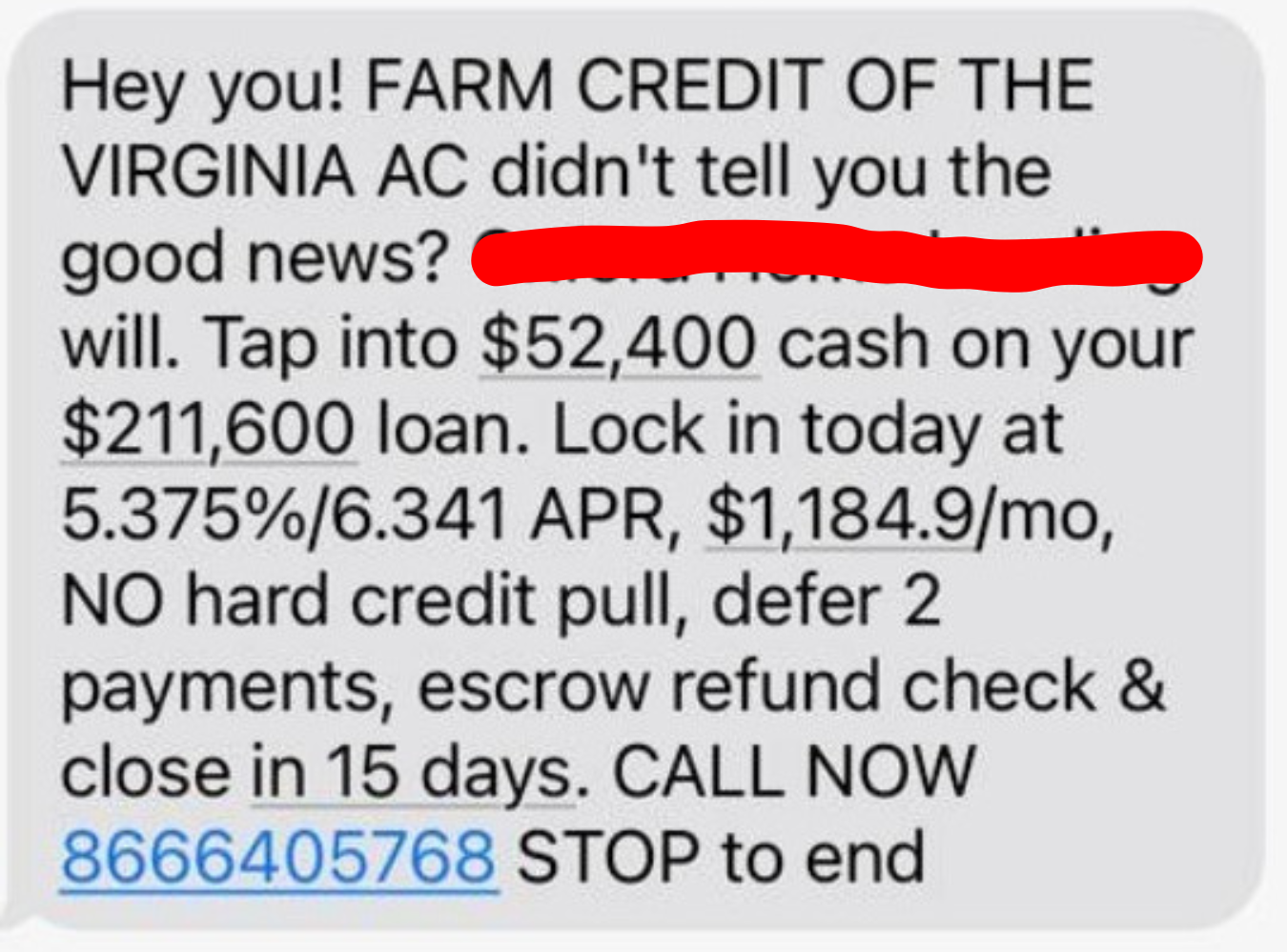

- Fraudulent Texts Regarding Your Loan

Farm Credit of the Virginias values your privacy and relationship with us as a customer-owner, therefore, we want to ensure you are aware of this trending scam. A few customer-owners received the below text message claiming to be affiliated with Farm Credit of the Virginias in an attempt to perpetuate fraud.

What should I do if I get this text?

Please let us know by calling (800) 919-3276 or by sending an e-mail to info@fcvirginias.com so that we may take appropriate action.

Fraud Resources

We’ve compiled the following tips and resources to help inform and protect our customer-owners from the growing threat of fraud. These resources are designed to raise awareness, offer practical steps for prevention and provide guidance on what to do if you’ve been affected.

- Tips for Protecting Yourself from Fraud & Identity Theft

Password Management Tips

Are you getting ready to create a new account or renew a password on an existing platform? Check out the password management tips below OR access our infographic HERE.

- Make them long, not complicated. Aim for at least 15 characters.

- Use a phrase if you cannot use a random 15-digit password. A memorable phrase like "2-Cows-in-the-morning-feed-on-hay" is stronger and easier to remember than "C0w$4ME&FCV". The longer the password, the better.

- Use a password manager. This will keep you from having to memorize passwords for multiple sites, thus making it less appealing to reuse password, or variations of one or two passwords.

- Never reuse passwords across accounts. If one site gets breached, hackers will try that password everywhere else. A password manager makes this effortless since you don't need to remember unique passwords for each site.

- Enable multi-factor authentication (MFA) everywhere you can. Even if someone steals your password, MFA provides a second barrier. Use authenticator apps rather than SMS when possible, as they're more secure.

- Avoid security questions with public answers. Information like your mother's maiden name or the street you grew up on is often available on social media.

- Be wary of phishing. The strongest password won't help if you type it in a fake website. Always verify URLs before entering credentials and be suspicious of unexpected login requests.

Email Best Practice

- Avoid clicking on any links in unsolicited e-mails, particularly e-mails that ask (either directly or by pointing to a website) for personal, financial, or identity information. Instead, directly type the website URL into your browser to access the site. Access the Farm Credit of the Virginias website by typing the URL directly (https://www.farmcreditofvirginias.com)

- If you receive an e-mail that warns you, with little or no notice, that an account of yours will be shut down unless you reconfirm your billing information, do not reply or click on the link in the e-mail. Instead, contact the company cited in the e-mail using a telephone number or website address you know to be genuine.

- To stay up to date on current consumer scams and for more information check out the Federal Trade Commission Consumer Advice webpage here!

- Guidance Against E-Mail & Internet-Related Fraud

E-mail and internet-related fraudulent schemes, such as “phishing,” are being perpetrated with increasing frequency, creativity and intensity. Phishing involves the use of seemingly legitimate e-mail messages and websites to deceive consumers into disclosing sensitive material, such as bank or loan account information, Social Security numbers, credit card data, passwords and personal identification numbers (PINs). The perpetrator of the fraudulent e-mail message may use various means to convince the recipient that the message is legitimate and from a trusted source with which the recipient has an established business relationship. Techniques such as a false “from” address or the use of seemingly legitimate company logos, weblinks and graphics may be used to mislead e-mail recipients.

In most phishing schemes, the fraudulent e-mail message will request that recipients “update” or “validate” their financial or personal information in order to maintain their accounts, and direct them to a fraudulent website that may look very similar to the website of the legitimate business. These websites may include copied or “spoofed” pages from legitimate websites to further trick consumers into thinking they are responding to a bona fide request. Some consumers will mistakenly submit financial and personal information to the perpetrator who will use it to gain access to financial records or accounts, commit identity theft or engage in other illegal acts.

For more information around spoofing or phishing explore FBI resources here.

- Fraud Recovery Resources

It is an uneasy feeling when you misplace your wallet or realize you have been a victim of fraudulent activity. If you find yourself a victim of fraud, do not panic because resources are available. The Federal Trade Commission provides resources to help identify a recovery plan that you can access here.

Privacy & Security

Rest assured, protecting your personal information and privacy is a top priority in all aspects of our business. We are committed to maintaining the highest standards of privacy and security across all our systems and services. We understand your expectation of privacy and confidentiality of personal financial information when seeking the assistance of outside professionals to obtain credit. We have taken great care in establishing policies to protect your personal and financial information, as well as security procedures and internal controls to protect your privacy.