Consumer Fraud Alerts

Cyber fraud continues to rise, and we want to help keep our customer-owners informed and protected. Below are some of the latest scams making the rounds—stay alert and stay safe.

Keep in mind, if you receive a suspicious message that appears to be coming from us, or discover a potentially phony Farm Credit of the Virginias print or digital communication, please let us know by calling (800) 919-3276, or by sending an e-mail to info@fcvirginias.com so that we may take appropriate action.

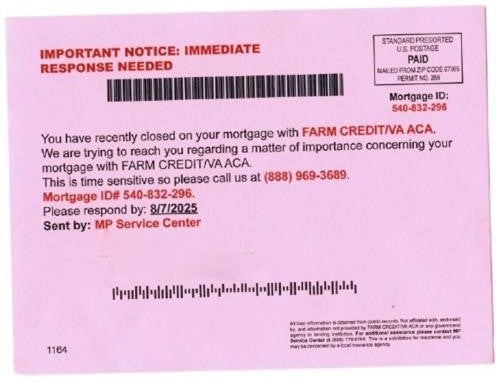

- Mortgage Postcard Scam

Have you received a postcard or letter about a time-sensitive issue with your loan account or mortgage urging you to call an unknown phone number? If you have, you are not alone. Scammers across the country are pulling public data records to target you and your information.

What are these postcards, and who is sending them?

We have been made aware of a postcard scam asking our customer-owners to call a number regarding a time-sensitive matter on their loan account. These postcards (which come in a variety of colors) are being sent to consumers across the country. Please be aware that this is a scam and the postcards did not come from Farm Credit of the Virginias, or any financial institution. There is even a disclaimer in the bottom right corner indicating the sender is not affiliated with our ACA.

How did the postcard senders get my information?

At Farm Credit of the Virginias, we’re committed to protecting our customer’s personal information. We would never send you a postcard requesting that you call us regarding your mortgage or loan account. Likewise, we do not sell or otherwise distribute our customer's personal information to non-affiliate third parties. However, some information about loans and mortgages, regardless of what lender the consumer works with, is public record. That’s how someone like this may obtain your contact information. Note that the account number listed does not match yours; this should immediately alert you to the likelihood of this being a scam.

Should I call the number on the postcard?

We advise our customer-owners to NOT call the number listed.

What should I do if I get this postcard?

The best thing to do is disregard the postcard. You're encouraged to dispose of it however you would any other junk mail you receive. In addition, please let us know by calling (800) 919-3276 or by sending an e-mail to info@fcvirginias.com so that we may take appropriate action.

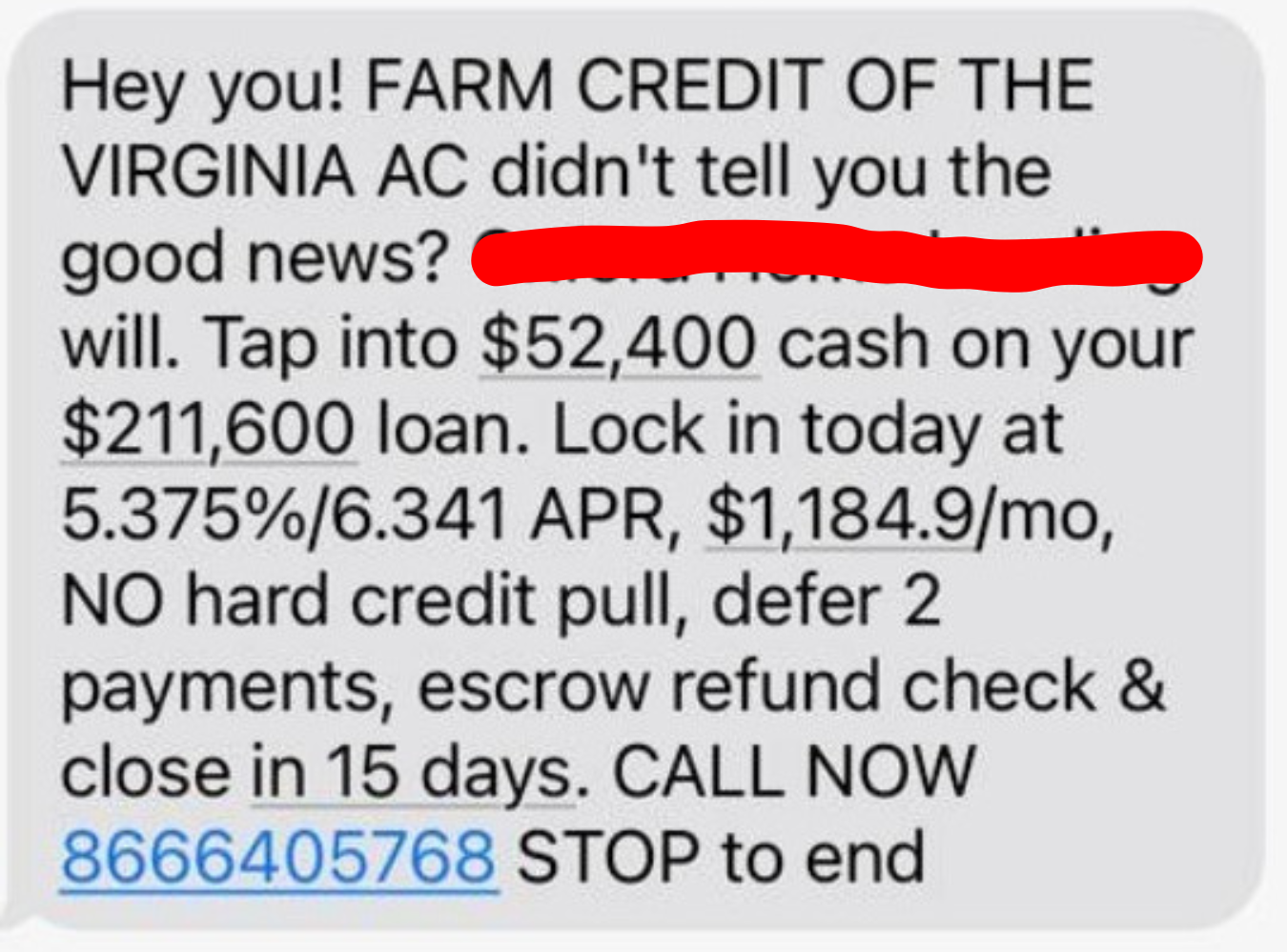

- Fraudulent Texts Regarding Your Loan

Farm Credit of the Virginias values your privacy and relationship with us as a customer-owner, therefore, we want to ensure you are aware of this trending scam. A recent scam impacting a few customer-owners received the below text message claiming to be affiliated with Farm Credit of the Virginias in an attempt to perpetuate fraud.

- USPS Text Scam

Have you ever gotten a text message about a package coming via the United States Postal Service? Maybe it confirmed your order, said a package is out for delivery, or said there’s a problem like unpaid postage, a missed delivery, or you need to update your shipping preferences. That text message will say to click a link to learn more or fix the problem. There’s a good chance that text message that says it’s from USPS (or FedEx, UPS, DHL, etc.) is really from a scammer. Learn more about this trending scam here.

Check out these resources to help you weed out spam text messages, phishing emails and unwanted calls.

If you believe you've received a fraudulent text message, you're encouraged to file a complaint at ftc.gov, then visit ftc.gov/idtheft to learn how to minimize your risk of damage from identity theft.

- Toll Scam

Have you received a suspicious text claiming you owe a toll fee? This is a widespread fraud attempt designed to trick recipients into clicking malicious links or sharing personal information. Watch the video below to learn more.

Check out these resources to help you weed out spam text messages, phishing emails and unwanted calls.

If you believe you've received a fraudulent text message, you're encouraged to file a complaint at ftc.gov, then visit ftc.gov/idtheft to learn how to minimize your risk of damage from identity theft.

Fraud Resources

We’ve compiled the following tips and resources to help inform and protect our customer-owners from the growing threat of cyber fraud. These resources are designed to raise awareness, offer practical steps for prevention and provide guidance on what to do if you’ve been affected.

- Fraud Recovery Resources

It is an uneasy feeling when you misplace your wallet or realize you have been a victim of fraudulent activity. As of 2021, approximately 1 in 5 people had experienced identity theft in their lifetime. (Bureau of Justice Statistics). If you find yourself a victim of fraud, do not panic because resources are available. The Federal Trade Commission provides resources to help identify a recovery plan that you can access here.

- Guidance Against E-Mail & Internet-Related Fraud

E-mail and internet-related fraudulent schemes, such as “phishing,” are being perpetrated with increasing frequency, creativity and intensity. Phishing involves the use of seemingly legitimate e-mail messages and websites to deceive consumers into disclosing sensitive information, such as bank or loan account information, Social Security numbers, credit card numbers, passwords and personal identification numbers (PINs). The perpetrator of the fraudulent e-mail message may use various means to convince the recipient that the message is legitimate and from a trusted source with which the recipient has an established business relationship. Techniques such as a false “from” address or the use of seemingly legitimate company logos, weblinks and graphics may be used to mislead e-mail recipients.

In most phishing schemes, the fraudulent e-mail message will request that recipients “update” or “validate” their financial or personal information in order to maintain their accounts, and direct them to a fraudulent website that may look very similar to the website of the legitimate business. These websites may include copied or “spoofed” pages from legitimate websites to further trick consumers into thinking they are responding to a bona fide request. Some consumers will mistakenly submit financial and personal information to the perpetrator who will use it to gain access to financial records or accounts, commit identity theft or engage in other illegal acts.

- Tips for Protecting Yourself from Fraud & Identity Theft

The safest approach is to immediately delete e-mail from unknown sources, before opening the e-mail.

Avoid clicking on any links in unsolicited e-mail, particularly e-mails that ask (either directly or by pointing to a website) for personal, financial, or identity information. Instead, directly type the website destination into your browser or use a trusted bookmark to verify the site or to log into your account directly.

Always access our website by directly typing our website address into your browser. Check to ensure you have typed the address correctly before providing personal information on the site.

If you receive an e-mail that warns you, with little or no notice, that an account of yours will be shut down unless you reconfirm your billing information, do not reply or click on the link in the e-mail. Instead, contact the company cited in the e-mail using a telephone number or website address you know to be genuine.

You may also wish to contact your Internet Service Provider for support in blocking e-mails or subscribing to a “spam” or junk e-mail filter they may offer.

Ensure your home computer has adequate anti-virus software and remember to update it frequently.

Privacy & Security

Rest assured, protecting your personal information and privacy is a top priority in all aspects of our business. We are committed to maintaining the highest standards of privacy and security across all our systems and services. We understand your expectation of privacy and confidentiality of personal financial information when seeking the assistance of outside professionals to obtain credit. We have taken great care in establishing policies to protect your personal and financial information, as well as security procedures and internal controls to protect your privacy.