Manage your risk with crop insurance

Let’s face it – farming is risky. Weather, disease and changing markets can all impact the commodities your farm produces and impact your earnings and cash flow. The good news is you can protect your farm and everyone who depends on it by managing those risks with crop insurance, also referred to as commodity insurance. Who can best help evaluate the risks and customize a plan to manage them? Look no further than your agricultural finance experts at Farm Credit!

Farm Credit is a cooperative, so we pride ourselves on taking care of our customers. We have full-time commodity insurance agents who have years of policy writing and risk management experience. Our agents will work closely with you to help reduce the production and price fluctuation risk associated with your crops, forages and livestock. Let us help ensure your farm’s viability and success!

- Why do I need crop insurance?

Crop insurance is a risk management tool that builds a safety net under your income and cash flow. Wet planting seasons, floods, droughts, wind and hail storms are all part of farming. They can impact your farm’s cash crops as well as the pasture and forage for your livestock operation. Price fluctuations on livestock can drastically impact profitability and cash flow as well. Commodity insurance protects your farm against those risks so you can meet your personal and business goals.

- How much does crop insurance cost?

Through our multiple insurance providers, our agents have access to systems that allow you to compare several coverage levels to pick the one that best suits your farm operation. As with any insurance, the cost is relevant to the size of the underlying risk. Our commodity insurance agents are up-to-date on all policy options and they can help save you money in premiums.

- How do I sign up?

Simply give us a call at 800-919-FARM (3276) to talk with your loan officer today. Our agents will help you understand which products are available in your county, and the important features of each product.

Types of Crop Insurance

- Yield Protection (YP)- Our Yield Protection (YP) policy insures producers against production losses due to a covered cause of loss such as drought, excessive moisture, hail, disease or wildlife. YP policies also provide replant, late planting, and prevented planting coverage. The producer selects the percentage of their average yield they would like to insure ranging from 50-85%. A loss would occur when the harvested yield is less than the guaranteed yield on the policy as the result of a covered cause of loss.

- Revenue Protection (RP)- Our Revenue Protection (RP) provides comprehensive protection that covers weather-related, and other certain unavoidable causes of loss and price fluctuations. RP provides the same coverage as YP with the addition of price protection.

Additional Coverages Available

- Livestock Gross Margin (LGM)

- Livestock Risk Protection (LRP)

- Pasture, Rangeland & Forage (PRF)

- Supplemental Coverage Option (SCO)

- Crop hail policies

- Coverage for orchards, vineyards, nurseries, processing, fresh market vegetables, tobacco, organic crops, etc.

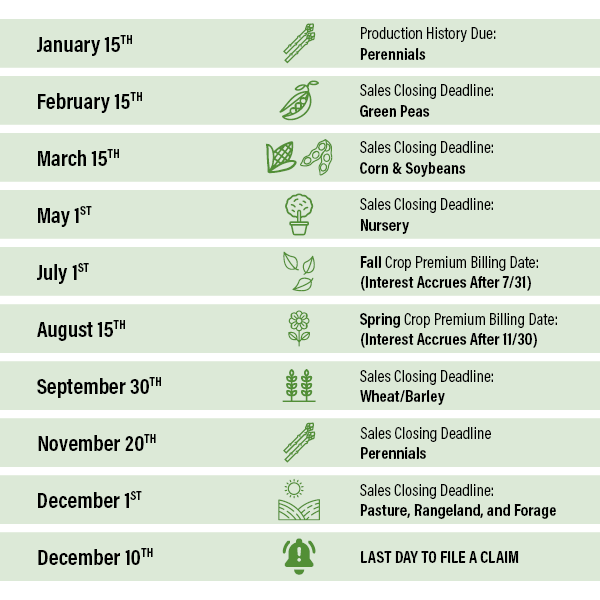

2026 Crop Insurance Deadlines

Partner Providers:

Farm Credit is proud to partner with the following companies: Rain and Hail LLC, QBE NAU and Rural Community Insurance Services (RCIS)